Wildfires Without End: In a World of Extreme Heatwaves, Where Does the Road to Decarbonization Go?

Malaysia’s New Energy Vehicle (NEV) Development Status and BEV Application Requirements

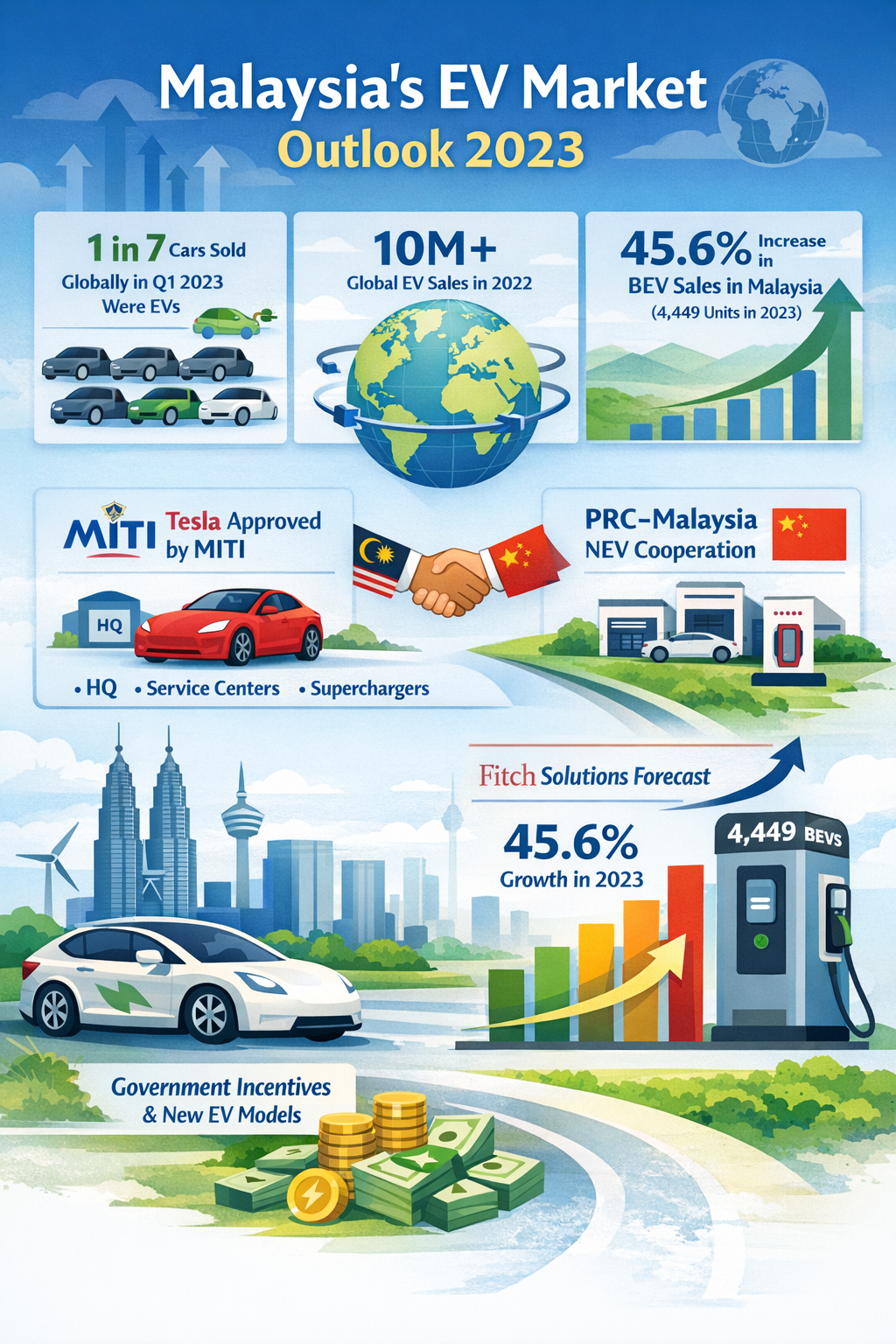

In the first quarter of 2023, in the global electric vehicle market, one out of every seven passenger cars sold was an electric vehicle. Today, the global transition toward a clean-energy economy is accelerating, and consumer demand for electric vehicles (EVs) continues to rise. Last year, global EV sales surpassed 10 million units for the first time.

In Southeast Asia, demand for passenger EVs is also increasing. Given international automakers’ growing interest in investing in the region, Southeast Asian countries are making every effort to accelerate the development of the EV industry. Recently, Johnny Cui Law Firm has provided commercial legal services to several PRC-based new energy vehicle and auto-parts enterprises, including matters such as Chinese-invested companies’ market entry and expansion in Malaysia, as well as cooperation with Malaysian new energy enterprises.

In March this year, Malaysia’s Ministry of International Trade and Industry (MITI) officially announced the approval of Tesla’s application to export battery electric vehicles (BEVs) into Malaysia. Tesla will also establish an operational headquarters, inspection and maintenance facilities, service centers, and build out a “Supercharger” network in Malaysia. According to Bernama, Tesla’s presence in Malaysia is expected to enhance technical capabilities and proficiency among workers in the BEV sector, and to create higher-paying job opportunities for industry participants.

Driven by additional government incentives and new models at more accessible price points, demand for EVs in Malaysia is expected to surge in 2023. Based on forecasts by Fitch Solutions, a leading global credit ratings and research provider, Malaysia’s BEV adoption is projected to increase, with 2023 sales expected to grow 45.6% to 4,449 units.

A study released in February by PwC Strategy& (Germany) noted that two-thirds of global BEV sales in 2022 were in China. As global BEV sales grew 70% year-on-year in 2022, China—remaining the world’s largest market—continued its rapid expansion in recent years. In addition, the U.S. EV market also showed strong momentum, while the five largest European markets recorded 28% sales growth last year.

In ASEAN, however, EV sales remain relatively small in global terms, accounting for only 0.5% of global EV sales in 2022. According to data from market research firm Counterpoint Research, passenger EV sales in Southeast Asia represented less than 2% of total passenger car sales in 2022.

Although NEV penetration in ASEAN is still comparatively low, a combination of factors—including improving manufacturing capabilities, advantages in mineral resources, and growing international investor interest—suggests that ASEAN’s EV sector will remain an attractive long-term option for investors.

Last month, at the ASEAN Summit held in Labuan Bajo, Indonesian President Joko Widodo stated that ASEAN leaders had agreed to foster the EV industry in the region, with the goal that it would one day serve not only regional demand, but also markets beyond ASEAN.

#01 Malaysia’s EV Landscape (Current Status)

To further attract investment and accelerate the development of the EV industry across ASEAN, Indonesia—the world’s largest producer of nickel (a key material for EV batteries), Thailand—whose EV adoption rate is far ahead of other ASEAN members, and Malaysia—the third-largest automotive market in ASEAN—have all introduced EV tax incentives (including exemptions or reductions for excise duties, import duties, and road tax). Through these incentive measures, each country aims to secure a stronger position in the region’s NEV race.

In Indonesia, Hyundai Motor Group and LG Energy Solution have begun building EV and battery manufacturing facilities. The Indonesian government is also actively promoting investment and production cooperation with China’s BYD Group and the U.S.-based Tesla. In Thailand, following the government’s release of an overall NEV development roadmap and a series of investment promotion incentives, the country has attracted hundreds of billions in investment into the NEV sector.

As the third-largest automotive market in ASEAN, Malaysia has a smaller population, but its strong E&E (electrical and electronics) supply chain and higher per-capita income contribute to relatively faster BEV adoption. These factors are also key reasons why, amid intense regional competition, Malaysia was among the first to gain the attention of EV giant Tesla.

In December last year, the Malaysia Automotive Association (MAA) noted that, provided tax incentives for completely knocked down (CKD) and completely built up (CBU) vehicles remain in place, Malaysia’s EV sales could potentially exceed the forecast previously projected by Fitch Solutions.

In Malaysia, the EV and EV-parts sector currently benefits from exemptions on taxes such as import duties and excise duties, as outlined below:

Until 31 December 2027, import duty exemption for imported automotive components used for local assembly.

Until 31 December 2027, excise duty and sales tax exemptions for locally assembled electric vehicles (CKD).

Until 31 December 2025, import duty and excise duty exemptions for fully imported electric vehicles (CBU).

Corporate income tax exemption for charging equipment manufacturers for the 2023–2032 years of assessment, and a 100% investment tax allowance for five years.

Meanwhile, the government is also accelerating the build-out of EV charging infrastructure, with a plan to establish at least 10,000 public charging points for EVs by 2025.

#02 Malaysia BEV Application (Requirements & Process)

Maybank Investment Bank (IB) Research stated in a report that electrification will become a key agenda for Malaysia’s automotive industry, and will also serve as a major magnet for attracting new foreign direct investment (FDI).

On 3 January this year, the Malaysian government issued the latest BEV approval permit to help plan domestic market demand for battery electric vehicles and, over the medium to long term, further promote the development of the overall ecosystem for this category. The implementation period for this AP application is 1 January 2023 to 31 December 2025.

Under the latest BEV approval permit procedure, specific requirements are set out for applicants’ eligibility, including performance track record requirements over the past five years, charging technology requirements, and the production and supply of supporting battery products. The new rules also provide detailed requirements on the number and proportion of local employees/technical staff to be hired, the establishment of an operational headquarters as well as sales and experience centres, the deployment of fast-charging equipment, and cooperation with local supporting enterprises or academic institutions.

It should be noted that the new rules define EVs explicitly as BEVs, meaning the vehicles must be battery electric vehicles, and the scope is limited to passenger cars.

※ The above content is compiled and edited by Johnny Cui Law Firm.

Reproduction or redistribution is permitted only with proper source attribution.

Wildfires Without End: In a World of Extreme Heatwaves, Where Does the Road to Decarbonization Go?

Malaysia’s New Energy Vehicle (NEV) Development Status and BEV Application Requirements

Singapore's Key Policies on Carbon Emissions Reduction

Southeast Asia emerging market e-commerce growth observation